Beyond the Best Rate: A Strategic Guide to Securing Optimal Auto Financing in 2025

The question, “Which bank is best for an auto loan?” is fundamentally flawed. It presupposes a single, universal answer in a financial landscape defined by nuance, individual circumstance, and strategic opportunity. The sophisticated borrower understands that the goal isn’t merely to find the “best bank,” but to engineer the most advantageous financing structure for their specific profile and purchase. This involves a multi-layered approach that dissects the offerings of national banks, online lenders, and credit unions, leveraging their unique strengths to minimize the total cost of vehicle ownership.

This advanced guide will deconstruct the complex world of auto financing, moving beyond advertised rates to explore the intricate mechanics of loan structures, the strategic value of pre-qualification, and the subtle art of negotiation. We will analyze the key players across the lending spectrum, providing a blueprint for securing a loan that is not just approved, but optimized.

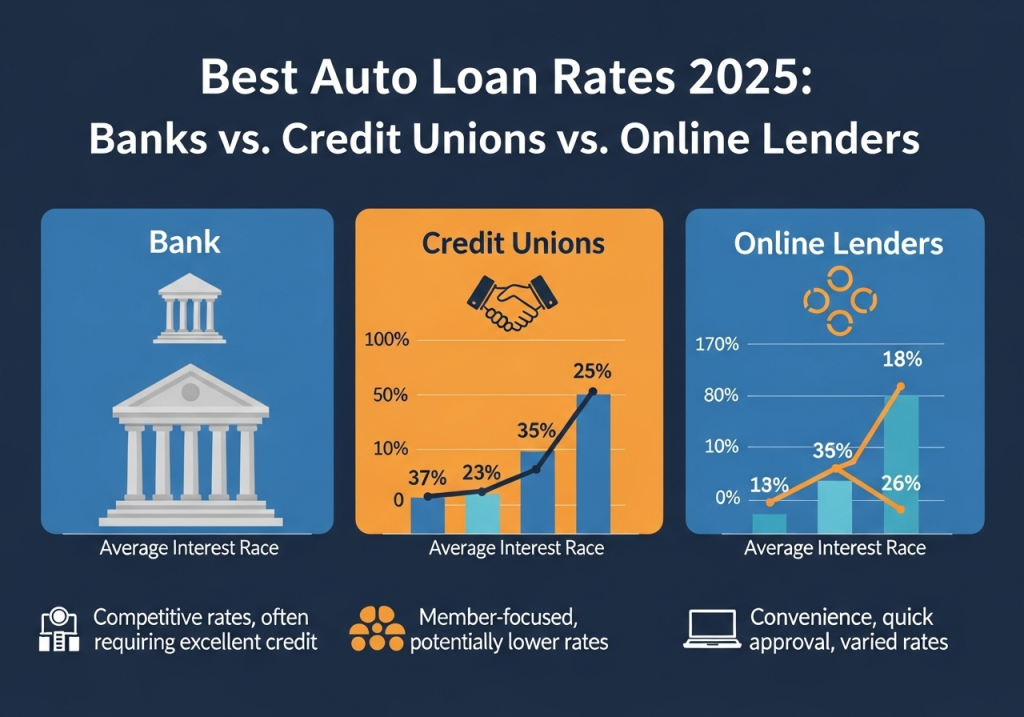

The Modern Financing Triad: Banks, Online Lenders, and Credit Unions

The auto loan market is no longer a simple dichotomy between your local bank and the dealership’s finance office. Today, it is a dynamic ecosystem composed of three primary pillars, each with distinct advantages and disadvantages.

- National Banks: The Bastions of Tradition and Relationship Benefits. Large institutions like Bank of America and Chase offer the familiarity of a physical footprint and the potential for relationship-based discounts.[1][2] A long-standing history with a bank, particularly holding significant assets in checking or investment accounts, can unlock preferential rates.[1][2] For instance, Bank of America’s “Preferred Rewards” members may qualify for notable APR discounts.[1] However, these institutions can sometimes be less nimble, with stricter qualification criteria and potentially less competitive rates for those without an established relationship.

- Online Lenders & Aggregators: The Apex of Speed and Comparison. The digital revolution has spawned a new breed of lenders and aggregators like LightStream, Autopay, and myAutoLoan.[1][3] Their primary strengths lie in their streamlined application processes, rapid decision-making, and the ability to provide multiple offers from a network of lenders with a single application.[1][3] This competitive environment can drive down rates. Many of these platforms offer the crucial advantage of a pre-qualification process using a soft credit inquiry, which allows you to see potential rates without impacting your credit score.[4][5][6][7][8] This is an indispensable tool in the initial stages of your research.

- Credit Unions: The Member-Focused Value Proposition. As not-for-profit, member-owned institutions, credit unions like PenFed, Navy Federal, and Consumers Credit Union consistently offer some of the most competitive interest rates on the market.[1][9][10] Because they return profits to members in the form of lower rates and fees, their primary objective is member benefit, not shareholder profit.[10][11] Data frequently shows a significant spread between the average auto loan rates at credit unions versus traditional banks.[10][12] The main perceived hurdle—membership eligibility—is often broader than many assume, with many credit unions offering pathways to membership for the general public.[1]

Deconstructing the Deal: Key Factors for the Advanced Borrower

A low Annual Percentage Rate (APR) is paramount, but it is only one component of an optimal loan structure. The discerning borrower must analyze a range of variables.

Beyond the Rate: Discounts and Incentives

Many lenders offer rate reductions that can be strategically combined to lower your borrowing cost.

- Autopay Discounts: A common incentive, often providing a 0.25% to 0.50% rate reduction for setting up automatic payments from your bank account.

- Car-Buying Service Discounts: Some credit unions, like PenFed and Consumers Credit Union, partner with car-buying services such as TrueCar.[1][9] Financing through these services can unlock an additional rate discount, sometimes as much as 0.50%.[9]

- Relationship Discounts: As mentioned, major banks may offer rate reductions for existing customers who meet certain balance requirements.[1]

- Military and Special Group Discounts: Lenders like Navy Federal offer exclusive discounts for active duty military members and veterans.[13]

Loan Structure and Flexibility

- Loan Term: While a longer loan term (72 or 84 months) results in a lower monthly payment, it dramatically increases the total interest paid over the life of the loan. A sophisticated borrower will use an auto loan calculator to model the total cost of different loan terms, balancing monthly affordability with long-term savings. Lenders may also have a minimum loan amount for longer terms.[14][15]

- Prepayment Penalties: It is crucial to confirm that your loan does not have a prepayment penalty. This ensures you have the flexibility to pay off the loan early, either through a lump sum or by making extra payments, without incurring additional charges. Some lenders may have specific rules, such as levying a fee for pre-closure within the first year or two.

- Loan-to-Value (LTV) Ratio: The LTV ratio compares the amount of your loan to the actual cash value of the vehicle. A lower LTV, achieved through a larger down payment, reduces the lender’s risk and can result in a more favorable interest rate. Some credit unions may even finance up to 130% of the vehicle’s retail value, which can be useful for covering taxes and fees but will result in a higher overall loan cost.

The Strategic Approach to Securing Your Loan

Phase 1: Pre-Qualification and Research (No Credit Score Impact)

Your journey should begin weeks before you step into a dealership. The initial goal is to gather intelligence without affecting your credit score.

- Know Your Credit Score: Obtain your credit report from all three major bureaus. Your score is the single most significant factor in determining your interest rate.

- Leverage Soft Inquiries: Utilize online lenders and aggregators like Capital One Auto Navigator, CarMax, and others that offer pre-qualification with a soft credit pull.[4][16] This allows you to see realistic rate estimates from multiple lenders.[8]

- Research Credit Unions: Investigate credit unions for which you may be eligible. Many have open membership requirements. Compare their advertised rates to the pre-qualified offers you have received.

Phase 2: Pre-Approval and Negotiation

Once you have a clear picture of the rates you can likely obtain, it’s time to get a firm offer.

- Select Your Top Lenders: Based on your research, choose 2-3 of the most promising lenders (this could be a mix of an online lender, a credit union, and your personal bank).

- Seek Pre-Approval: Formally apply for pre-approval from these selected lenders. This will result in a hard credit inquiry, but multiple inquiries within a short period (typically 14-45 days) are usually treated as a single event by credit scoring models, minimizing the impact.

- Walk into the Dealership as a Cash Buyer: With a pre-approval letter in hand, you have immense negotiating power. You have separated the car purchase from the financing, allowing you to focus solely on the vehicle’s price. You are now, for all intents and purposes, a cash buyer.

Phase 3: The Final Decision

Even with pre-approval, always give the dealership’s finance manager a chance to compete. They have access to a network of lenders, including the manufacturer’s own financing arm, which may be offering promotional rates (like 0% APR) on certain models.[12][17]

Present your best pre-approved offer and ask them if they can beat it. If they can offer a lower APR with no hidden fees or extended terms, it may be worth considering for the sake of convenience. However, with your pre-approval, you are negotiating from a position of strength and can confidently walk away if their offer is not superior.

Lender Profiles for the Discerning Borrower

- For the Rate-Focused with Excellent Credit: Credit Unions like PenFed and Navy Federal are often the top contenders, offering rock-bottom APRs for highly qualified borrowers.[1] LightStream, an online division of Truist Bank, is also known for its competitive rates and streamlined, unsecured loan process for those with strong credit.[3][18]

- For the Digitally Savvy and Comparison Shopper: Autopay and myAutoLoan are powerful aggregators that provide multiple offers, making them excellent starting points for seeing a wide range of options.[1][3] Capital One’s Auto Navigator tool is also highly regarded for its user-friendly interface and pre-qualification process.[1]

- For Borrowers with Bruised Credit: While securing a low rate is challenging, some lenders specialize in this area. Autopay can be a good option due to its large network of lenders, some of whom work with lower credit scores.[1] Prestige Financial and other specialized lenders cater to those with past bankruptcies or significant credit issues, though rates will be considerably higher.[19]

- For Those Valuing In-Person Service and Relationship Perks: Bank of America is a strong choice if you are a Preferred Rewards member, as the rate discounts can be substantial.[1]

Conclusion: The Power of Preparation

Ultimately, the “best bank for an auto loan” is not a name you find on a list, but a result you create through meticulous research, strategic timing, and informed negotiation. By understanding the distinct roles of banks, credit unions, and online lenders, and by leveraging modern tools like no-impact pre-qualification, you transform yourself from a passive loan applicant into an empowered financial architect. The time invested in this process before ever speaking to a car salesperson will yield significant returns, not just in a lower monthly payment, but in the total cost of your vehicle over the years to come.

Sourceshelp